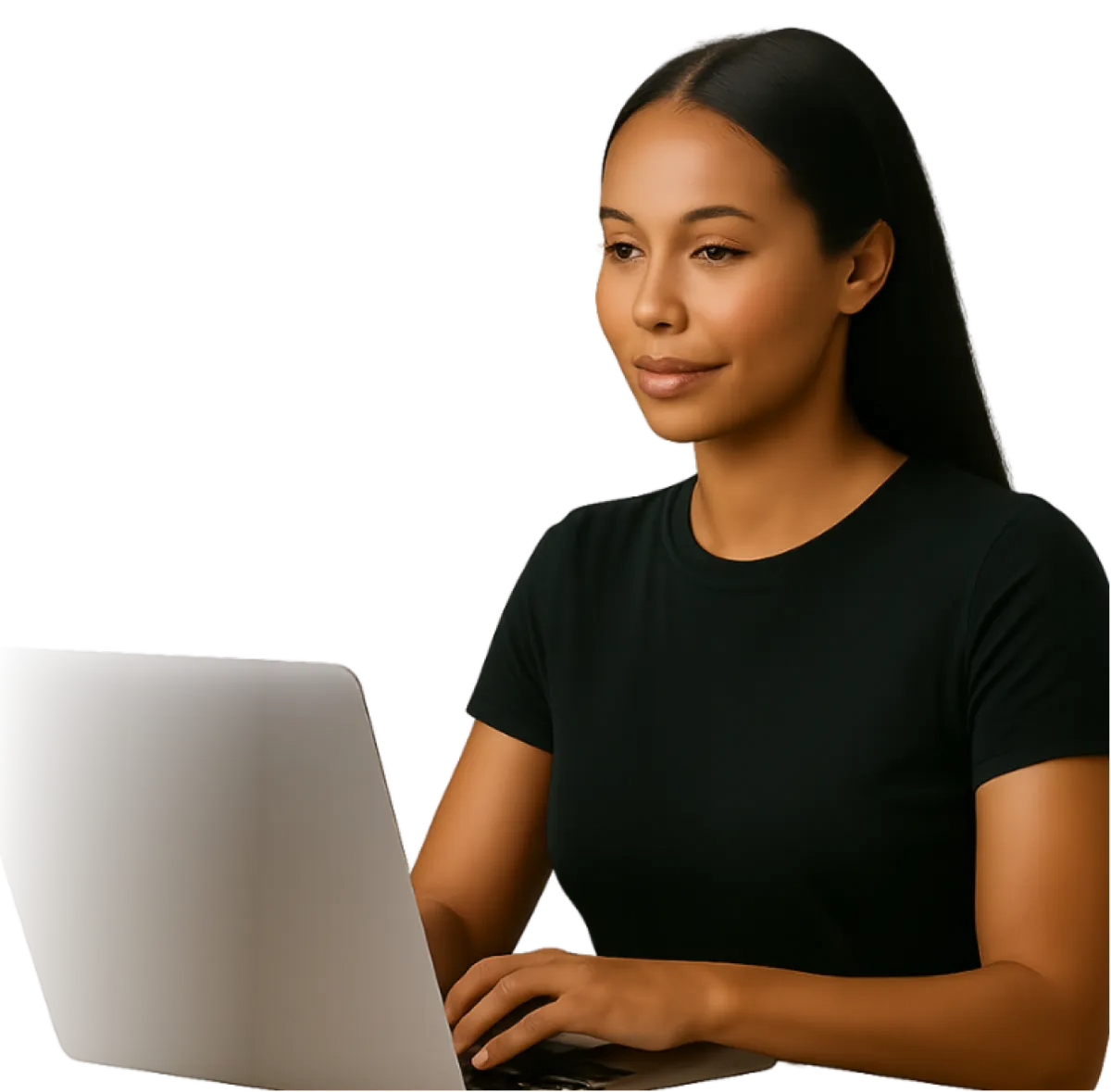

Business Term Loans With Built-In Clarity

Secure capital with predictable payments and no surprises.

What’s a Term Loan?

A term loan is lump-sum capital repaid over time with a fixed monthly payment. Great for planned investments, major purchases, or stabilizing your cash flow.

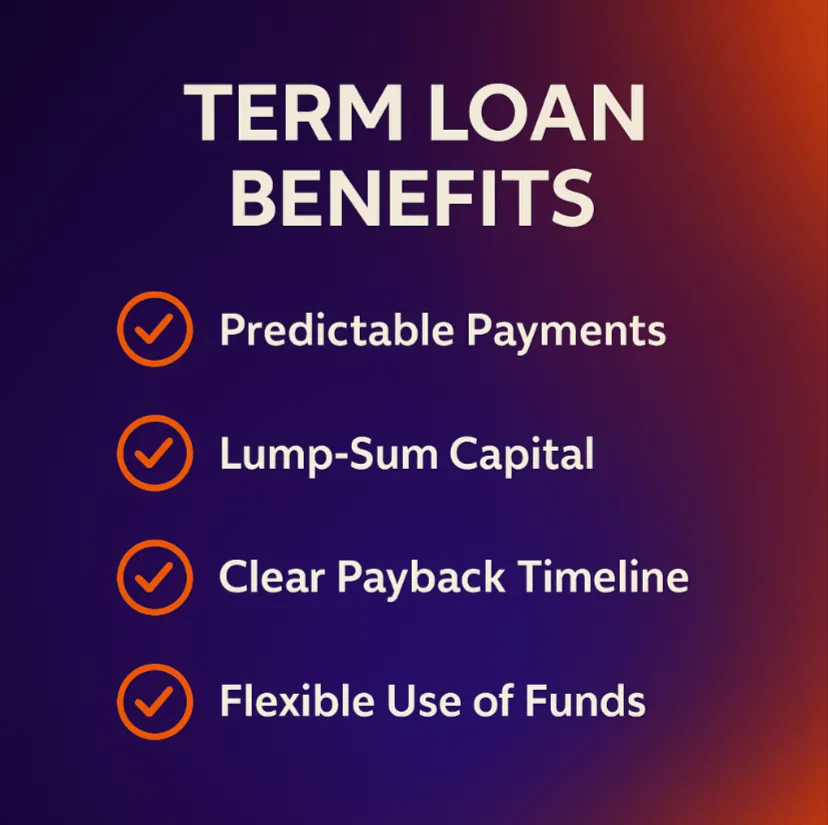

Why Founders Choose Term Loans

Predictable monthly payments

Repayment terms from 12–60 months

Lower interest rates than credit cards

Can be used for real estate, inventory, hiring, or expansion

Is a Term Loan Right for You?

You want to consolidate debt or fund growth

You need $25K–$500K for a clear use case

You prefer structured payments over flexible draws

You have strong business credit or cash flow

You've got an LLC or Corp (even brand new)

You're pre-revenue or recently launched

You want fast capital without giving up equity

You're working with a 680+ credit score

What You Get With ALT

ALT LEVERAGE

Soft pull pre-approval

Decision in 48 hours

Custom funding options

Founder-focused support

Traditional Bank

Hard inquiry required

Can take 2–6 weeks

One standard application

Call center or portal only

Credit score 680+

Registered business (LLC, Corp)

New or established

No W-2 income required

Looking for $10K–$250K

CLIENT QUOTE

If you are a small business, if you are an entrepreneur, if you are an Artist, I highly recommend working with Marco. He helped my business acquire $65k in funding.

Jameel,

Music Artist & Owner of Marketing Agency

Your Growth Deserves a Solid Plan

Let’s map it out with a smart, structured term loan.

© 2024 Altleverage | All Rights Reserved